Many years ago, my astute mother did her research about long term care insurance right when it became public. She asked her insurance selling son what he thought about it and to be honest, it was so new, I moved quickly to catch up with her. What I did know that making an annual payment toward that type of policy early on when she was at that much younger age would surely help her when she is older.

My Mom’s greatest fear has always been: “I don’t want you boys (me and my brother) to have that burden of responsibility when I get much older and can’t take care of myself.”

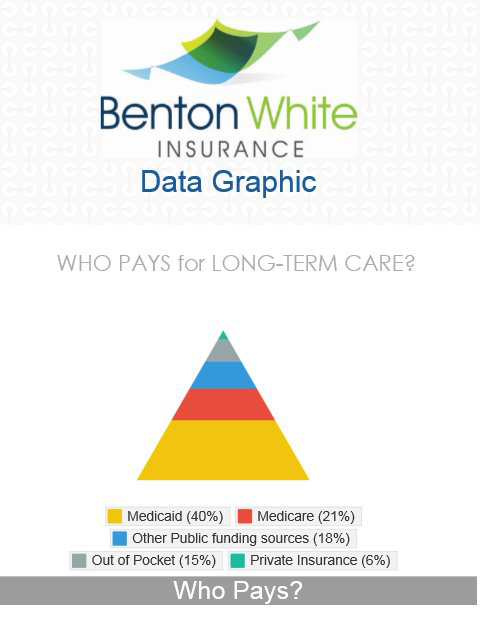

Private policies also offer a level of protection for family estates. Federal law stipulates that state Medicaid programs place liens against a recipient’s home or land to recover costs in the event of a death, except when specified hardships exist.

The coverage remains a good idea for people who want it, can afford it and qualify for it, he said.

Industry experts advise people to get the coverage at younger ages when they are more certain to qualify. While the premium payments won’t be a locked amount, future increases will be based on the age at which coverage began.

That means if an increase occurs when you’re 65 but you started coverage at age 51, your premium will be assessed as if you’re perpetually 51.

I have been marketing long term care insurance for many years. What I advise is that people should consider both age and the assets they want to protect when deciding whether to buy coverage. I strongly encourage a good decision time for this coverage is around age 50. Most folks around that age are in very good health and the premiums are still reasonable. I have several couples who have purchased long-term care insurance and they generally pay less for a joint policy than two individual policies

The older someone becomes, the less likely they are to get coverage. After age 60, we usually see about 25% of applicants can’t get coverage because they have health issues. The old adage is true – there is no better time than now to get Long Term Care insurance. Let me know if I can help you with it. It’s a coverage that shouldn’t be overlooked.

(Rising costs data source: American Association for Long Term Care Insurance)

If we can assist you with anything insurance, please let us know. We’re easy to reach! EMAIL us at info@BentonWhite.net or TEXT or CALL us at 615.377.1212. We are ready to earn your business!