One of many great things about what I do is that I have the privilege of talking to folks about their needs and concerns pertaining to life – preparing for the unknown and finding insurance solutions for the unexpected. Lately, there appears to be a pretty intense concern about Long Term Care (LTC) insurance. We have more cases pending right now than I can remember in recent memory.

We’re seeing couple after couple experience the concern because their parent(s) have grown older and needing special care as a result of aging. They see the expense and in many cases are paying the costs out of their pocket for that special care. Then they begin to be concerned about “what would happen when my spouse or I get old and WE can’t take care of ourselves? “ Our children could be saddled with those expenses!! Then they begin to consider solutions and Long Term Care insurance comes to the forefront.

I enjoy discussing insurance PERIOD! But Long-Term Care is a win-win for a family. It’s my job to show them how it is and how they can make theirs and their family’s future much brighter by spending “pennies on the dollar” now to insure what currently is a sizeable monthly expense for a special care facility for the aging parents or friends.

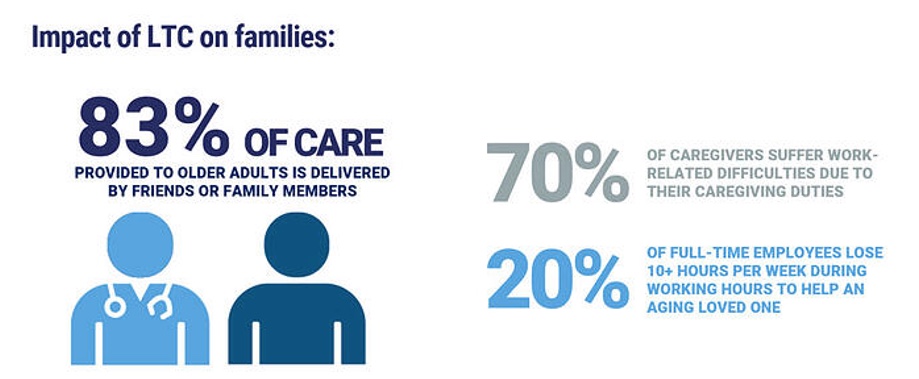

For many people in crisis that time may never come. For those who plan ahead, however, they may be able to navigate and control the type of crisis situation that has evolved. Consider the impact of LTC on a family:

One answer to these problems may be LTC Insurance, a product that can help someone who needs care with bathing, dressing, or has a severe cognitive impairment such as Alzhimers. It will provide a pool of money at time of need that can be used at home, for assisted living or even nursing home care. It will also help family members with coordination of care services.

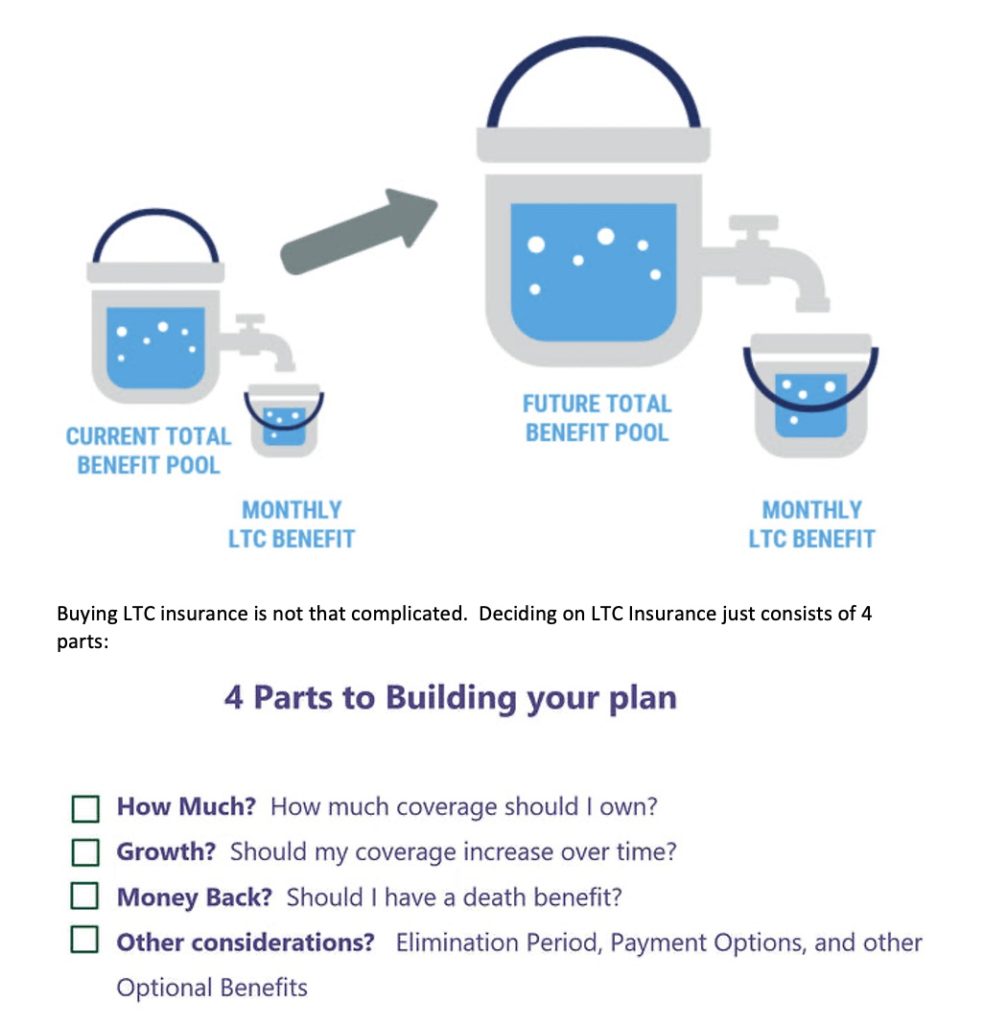

Here’s an example. John and Mary purchase a traditional long-term care insurance policy at age 55. They pay a combined premium of $5,000 annually. For that premium, they each have an initial benefit of $6,800 per month to use for care at home, assisted living, or in a nursing home. They each also have a total benefit maximum benefit pool of $244,800.

Their plan also includes an automatic benefit increase feature that increases the monthly benefit and total benefit pool by 3% compound. So, by the time they are 80 they will each have a total benefit pool of $497,628, or just about a combined million dollar in LTC benefit that can access.

Another way to decide how much coverage to purchase is my looking at the cost of care in your area. Some insurers have created cost of care maps to assist. As an example, if you lived in the Dallas Metro area wanted 8 hours of home health care per day for a year it would cost you $50,000 annually or $4,166 per month. You can then design a plan that fully covers that cost today and includes an automatic inflation protection to cover future care costs.

Care Management – another feature of LTC Insurance.

LTC Insurance can provide money to pay for care, but you still need someone to help arrange all the services – a big job! Many LTC policies include care coordination. Care management can help a family at time of crisis manage all the care options.

Too many people delay planning for care until it is too late.

Don’t forget – it is critical to plan for care now. As the pandemic has taught us, we never know what is around the corner – but those who plan ahead will be prepared. A product like LTC Insurance is best purchased when you are younger and premiums are lower. In addition, health can change at any time and LTC Insurance is only available to those who can pass a health screen.

At Benton White Insurance, we have OPTIONS that makes it better for those who we quote for the LTC coverage. We shop at least 6 companies and take the best 2 companies in coverages / premiums and present the best to the client. We brainstorm – they decide and we apply electronically – easily and quickly to solve their problem!

Can we help you? This need won’t go away and the sooner you do this while you are younger, the less premium you pay during the life of the policy.

We’re ready to serve YOU! If you have an insurance need or want to make sure YOUR insurance is most competitive, let us help! TEXT or CALL us at 615.377.1212. EMAIL us at INFO@BentonWhite.net or visit our website at www.BentonWhite.com for a wealth of helpful information – 24/7.

THANKS for the privilege we have in serving you, our customer. If you’re not one of our customers yet, come on over – we’ll treat you like we want to be treated!

Stay safe in your corner of this world!