I'm always amazed when I get offers in the USMAIL for auto or homeowners insurance. I got another one in the last few days at my residence!

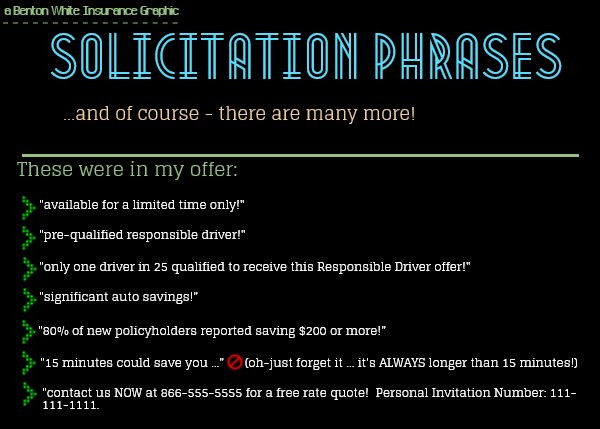

The envelope arrives looking SO official, no identification indicating who it is from – just a PO Box return address. I know it is mass mailed because there is nothing personal about it except my name and address is correct. Companies use all types of phrases to get your eyes on their mass-mail piece. I know you've seen these Solicitation Phrases:

So many questions arise and very few answers are given. I wonder many things like:

- Why is this offer available for a limited time only?

- How does Company A pre-qualify me when they SHOULDN'T have my driver's license or social security number?

- What does 'significant auto savings" really mean?? What scale do they use to rank significant

And I can guarantee you if I had a high-rated sports car (which I don't) and 2 tickets and an accident in the last 36 months (which I don't), I would NOT get their best rates.

I have more questions than those but I'll move on! After nearly 36 years in this business, here is what I know:

- A good agent can, in almost ALL CASES, beat another companys' premium pricing. That agent can manipulate coverage's, premium and pricing tiers so that their quote is lowest. I could do it everyday.

- Any agent can promise something when quoting and then once the policy goes to issuance or underwriting, something mysteriously changes! There are a number of factors that could change a quote if the agent doesn't completely research all angles of the quote in order to be accurate – NOT solely bottom-basement priced!

"You Get What You Pay For…"

I had a case this week where one of my experienced, money conscious clients called me to say…"I got this quote from Company B in the mail … They quoted X Tier of coverage and they are beating your property rate by X%. Since I also represented the company that the agent quoted to him, it took me 30 seconds to tell him why the quote was lower. The quoted premium tier offered 3 levels of less coverage. That quoted premium reflected a major degradation of coverage. Old adage applies: "you get what you pay for!". The client quickly said .."That's all I need to know … just wanted to check!"

At Benton White Insurance, we don't operate this way!! We quote coverage's that gives us and our clients the best ability to say YES at claim time when you really need us! I won't write insurance on anyone for the cheapest premium because the client ends up the loser! You are buying insurance for peace of mind and protection to help you with auto accident injuries, property fires, liability lawsuits, rental car coverage and so many other items we insure on your behalf. Even with my philosophy of ranking best coverage's over lowest price, we continually have premiums that are lower than most!

Don't get caught in the US MAIL solicitation racket – and yes I do mean racket! Know your coverage, know the agent you are working with and seriously review if the premium really is low because your current carrier is higher or is it really a "bait and switch" routine. Sadly, if you don't do your due diligence with your insurance, the latter could be the case! And if you ever have any questions or concerns you can always call me: 615 377-1212 or email: Benton@BentonWhite.com