Flooding is a deal these days! I can remember many years ago, no one talked about flooding and flood insurance to the high degree we hear now. FEMA – the government department that guides the flood insurance – has had to get more and more funds because more and more floods occurring in our country … At Benton White Insurance, we write flood insurance to help our clients handle this terrible possibility that could happen to their home because of too much water!

Despite having designated flood zones in cities and municipalities, the whole state of Tennessee is at risk for severe flooding due to its geographical location. Sitting right between the Smoky Mountains and the Cumberland Plateau, Tennessee was practically built for floods. In the more recent years, we’ve seen an increase in dangerous flash floods coming out of nowhere and destroying homes and infrastructure. This has in turn increased the number of properties in flood zones, but flooding is still a liability for those not in specified zones. Insurance is all about risk management and the best way to be prepared for unexpected losses is to have comprehensive polices protecting your assets.

Have you ever considered purchasing flood insurance? It may not seem necessary if your home has never flooded or if you live in a low-risk zone. However, the reality is that sometimes the things that could happen turn into the things that do happen and we want you to be prepared.

Let’s discuss some important things you should know about flood insurance and address a few common misconceptions.

The first and biggest misconception you might be thinking is that a standard homeowners policy covers flood; this is incorrect.

Most homeowners’ policies will not pay for damage due to flooding. While some companies provide coverage for events such as sewer backups, payment for damage from flooding requires a separate policy or endorsement.

Flood insurance can vary depending on the insurance company.

Our companies partner with the Federal Emergency Management Agency (FEMA) to market National Flood Insurance Program (NFIP) policies in communities that agree to participate. You may have thought that access to flood insurance depended on whether you lived in a high-risk or low-risk flood zone but this is another common misconception. As long as the community you live in agrees and participates in the federal program, then you can purchase an NFIP flood policy. If your community doesn’t participate, reach out to your local government officials (flood plain manger, etc.) to ask why. Most communities in Tennessee do participate.

NFIP flood insurance covers building and contents in the event of a flood.

It has to be a defined flood, which is outlined in your policy. Sometimes people think that a flood policy covers any type of water damage, which brings us to another misconception. NFIP policies only cover the water damage that resulted from the defined flood. Typically, a defined flood starts with surface water where it normally isn’t; it cannot be from water that starts underground. For lower levels, coverage can vary depending on whether it’s a basement or crawl space in addition to other factors. For questions about how your policy responds in the event of a flood, reach out to your local, independent agent.

Here at Benton White Insurance, we offer an additional option for flood coverage with Inland Flood coverage.

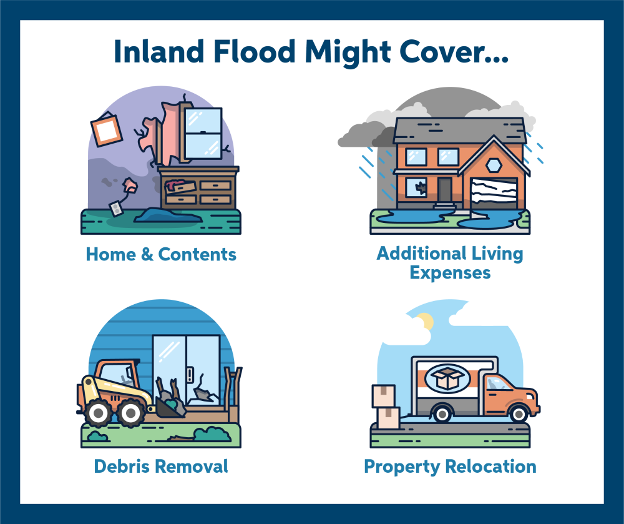

This can be added to our homeowners, dwelling fire and farm insurance policies. This coverage is not affiliated with the federal program and is not available to homes in or near high-hazard zones. It can be added to existing homeowners policies to cover your home, contents, additional living expense, debris removal and the cost to move covered property to safety. This coverage has a broader definition of “flood” and the coverage is generally less restrictive than NFIP policies.

You might be wondering if it’s necessary to purchase an NFIP flood policy if you add Inland Flood coverage. It depends on how much coverage you desire. Inland Flood has lower limits than NFIP policies, so, generally no, you do not need both.

The number one cause of property damage in the U.S. due to a natural disaster is flooding.

You might think it’s fire, wind, hail, etc., but flooding in low-risks zones alone produces 40% of all NFIP claims. Think of a hurricane for example. Flooding from this type of storm can cause more damage than catastrophic winds. The majority of floods occur from smaller, more isolated events, which is why, no matter where you live, it is important to be prepared and protect your home from flooding.

We hope you’ll never have to deal with your property flooding. But, in case it does, we want you to be prepared with the right coverage. For more questions related to flood insurance, please contact our office at 615.377.1212 or EMAIL us at info@BentonWhite.net … We’re here and ready to help as we work hard daily to “earn” your business.

Disclaimer: This article is not expert advice. The analysis of coverage is in general terms and is superseded in all respects by the Insuring Agreements, Endorsements, Exclusions, Terms and Conditions of the Policy. Some of the coverage mentioned in this material may not be applicable in all states or may have to be modified to conform to applicable state law. Some coverages may have been eliminated or modified since the publishing of this material. Discounts may not be available in all states. Limitations and conditions may apply. Premiums will be based on benefits chosen. Please check with your local Independent Auto-Owners Insurance Agent for details.

Copyright Auto-Owners Insurance Company © 2024. All Rights Reserved. This blog was locally edited by Maggie C. Howard