10 Largest Auto Insurers Each Raised Rates by Double Digits in 2023

There isn’t a day that goes by that we don’t discuss auto insurance rates and what it means to our customers. What we are all seeing right now with insurance rates is real folks.

I was speaking to an elderly lady yesterday who said ..”My auto rates continue to increase each time. We’re not driving much now and have had no claims! Why do we see this?” I told her that it’s not her or her husband’s fault – it’s all about the other drivers on the road who aren’t paying attention and continue to have accidents that in many cases could have been prevented if there had been more defensive driving. Couple that with the high costs for parts and labor at body repair shops. This creates a near-perfect storm for higher-than-normal insurance company payouts on claims. I admit, that wasn’t much consolation for her on a tight – retired budget and it’s not for any of us really. But those are the facts.

I continue to share with people that this is a nationwide issue with all insurance companies right now as is evident by this report I read earlier this week.

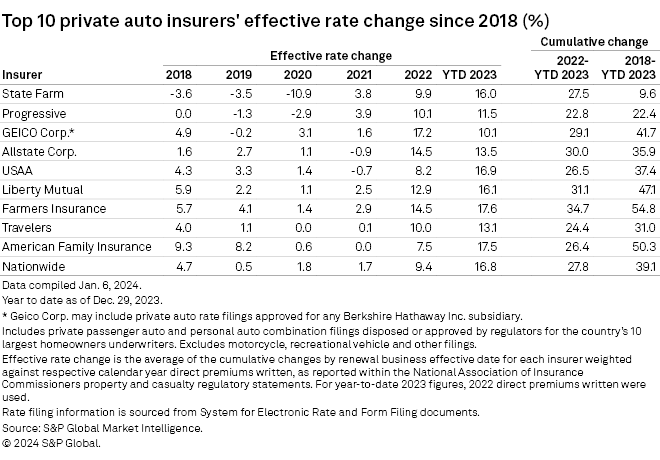

According to S&P Global Market Intelligence’s RateWatch, Farmers Insurance instituted double-digit rate increases in 43 states in 2023 for a weighted average rate increase of 17.6%—and its private auto insurance peers in the U.S. did the same.

All 10 of the top auto insurers in the U.S. raised rates double digits in 2023, with all but two—GEICO and Allstate—ending the year with higher rate increases than the prior year. The duo were among the insurers that raised auto rates the most in 2022.

American Family was very close behind Farmers when it came to rate increases in 2023, with 17.5%. USAA hiked auto rate 16.9%, with Nationwide, Liberty Mutual and State Farm also increasing rates at or above 16%, according to S&P GMI.

U.S. auto insurers had a tough time in 2023 as rate increases failed to keep up with jumps in claim frequency and severity. A previous report from S&P GMI observed that increases in severe auto crashes have resulted in a rise in litigated claims, and severe weather and a surge in vehicle thefts resulted in higher losses in comprehensive coverage.

2023 was the second year in a row that nationwide rate changes were above an average of 10%, pushed by increases above that mark in 43 states and the District of Columbia. The nationwide rate hike for 2023 averaged 14% after an average increase of 11.4% for the U.S. in 2022.

S&P GMI found that Nevada had the largest rate increase in 2023, at 28.3%, followed by Minnesota and Washington at nearly 20%. Hawaii, North Carolina, and Colorado each saw increases of less than 5% for the year.

Please know here at Benton White Insurance – we are watching all of this closely and offering our best advice to keep both your auto and home premiums in some reasonable range. Based on my past experience, this should pass in time – hopefully within the next 12 to 18 months but for now, our budgets have to be adjusted to pay for what is going on around us.

Feel free to reach out if we can help you with your insurance. We do our best to be available at the times you need us most. And if we are not, we have other avenues for you to connect. TEXT or CALL 615.377.1212, visit www.BentonWhite.com for a variety of information and service features that can assist you 24 hours each day. EMAIL us at info@BentonWhite.com or you can respond by text directly from our website.

We’re here – doing out best to earn your business. And if you aren’t with us yet, COME on over! We’ll treat you like we want to be treated and we will KNOW who you are in a language you can understand.

Thanks for reading the blog! Pass it along if it’s been helpful to you!

[Portions of this article taken from a public release by Insurance Journal written by Chad Hemenway | January 18, 2024)